“Cause I was a bit too leisurely”

(Prince – Raspberry Beret)

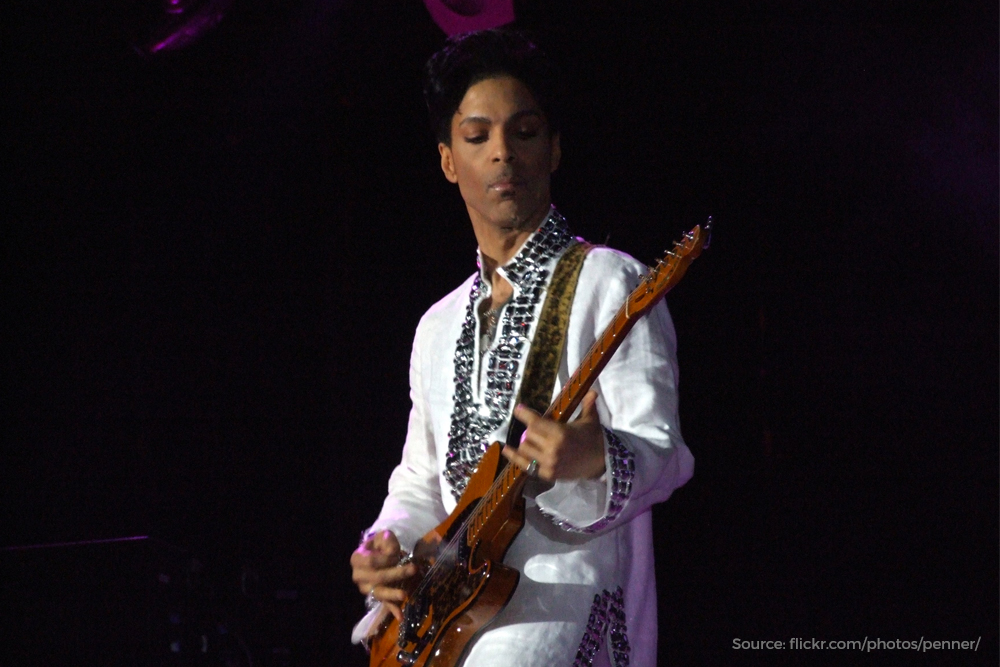

Prince playing at Coachella 2008.

Music superstar Prince was tragically found dead in his home last week at the age of 57. Prince was a musical genius. A generational talent. A songwriter, singer, multi-instrumentalist, record producer, and actor. He was known for his wide vocal range, flamboyant stage presence, and eclectic musical style.

Prince was also a philanthropist. Much of his generosity has come to light after his death. In 2011 he donated $250,000 to Eau Claire Promise Zone, a citywide grassroots coalition of community partners that was committed to doing whatever it takes to ensure urban youth were prepared to graduate from college and be successful in their career and life. He donated $1 million to the Harlem Children’s Zone, a non-profit organization for poverty-stricken children and families living in Harlem. In 2014 he donated $250,000 to the Uptown Dance Academy when he found out they were going to lose their space. He wrote a cheque for $200,000 to help turn an old nursing home into Harvest Prep and Seed Academy.

Surprisingly, it seems that Prince never made a will. Now, instead of being able to direct his multi-million dollar estate to be divided amongst his family, friends, and many charities he supported, the court has had to step in and appoint a corporate trust company to temporarily oversee the businesses and assets. The issue of the identities and addresses of Prince’s heirs will need to be determined through the court process.

Prince left no surviving parents or children, so his assets are likely to be divided among his siblings and half-siblings. If the parties cannot agree on the distribution, it will be up to the courts to decide.

We can only speculate, but given Prince’s interest in social causes, he would have intended to leave some money to charities. Unfortunately, without a Will or any trust documents, it is impossible to know what his intentions were.

We cannot advise on Minnesota law. However, in British Columbia when a person dies without a Will, their estate is distributed to their spouse and children. If there is no surviving spouse or children, then the estate is distributed to the deceased’s relatives in the following order: parents, siblings, grandparents, and aunts and uncles.

Distributing the assets of a loved one can be an emotional, complicated and lengthy process, no matter the size of the estate. Having a Will simplifies the process for your family and clarifies what your intentions are. There are a range of different documents and tools that can be used to protect your assets, preserve your estate, and provide peace of mind for you and your loved ones including: Will, Power of Attorney, Representation Agreement, Advance Directive, Family Trust, and/or Alter Ego Trust.

Prince’s untimely death is a reminder that you should consider your estate planning options, “before the grim reaper come knocking on your door” (Prince – Let’s Go Crazy). If you would like to get your own estate planning in order, contact Michael Poznanski for a free initial consultation.